Use a Letter of Instructions to Clarify Your Wishes to Your Loved Ones

A will is a key element of an estate plan. Most people have already drafted their wills, but have you considered adding a letter of instructions? The letter, unlike a valid will, isn't legally binding, but can help your surviving family members follow your intentions. This article explains what a letter of instruction should cover and why it can be a valuable addition to your estate plan.

Insights Into Small Business Bankruptcies

Many U.S. businesses filed for bankruptcy last year. Through the end of the third quarter of 2024 (the latest available statistics at this writing), formal bankruptcy filings were on track to exceed the 2023 mark and the watershed year of 2020. Here's a look at what's driving the increase and how the process works, including revised rules for small businesses that went into effect in 2022.

Federal Estate and Gift Tax Outlook 2025

The Tax Cuts and Jobs Act (TCJA) significantly increased the unified federal estate and gift tax exemption through the end of 2025. However, for 2026, it's currently scheduled to revert back to the pre-TCJA level with a cumulative inflation adjustment for 2018 through 2025. If it reverts back to previous levels, it's estimated to be roughly $8 million.

Bunting, Tripp & Ingley, LLP Year End Letter 2024

We are almost at the start of a new year! We have all faced challenging changes in tax laws, rising interest rates, and inflation this year. Congress may enact additional legislation in the upcoming year to include retroactive reinstatement of a few tax extenders that expired at the end of the 2023 tax year. Prospects of substantial changes in legislation seem to be slim during the remainder of the year.

Alternative Investments: Going Mainstream

Oops ... Do You Need to Amend Your Tax Return?

The COVID pandemic prompted numerous temporary changes to the tax laws for 2020 and 2021. From Economic Impact Payments, penalty-free IRA distributions and the expanded child tax credit to Employee Retention Credits and credits for paid leave, taxpayers had ample areas to make mistakes when completing their tax returns — on top of the usual annual tripwires.

Good News: IRS Boosts Standard Mileage Rates for Second Half of 2022

How Do I Know What My Home is Really Worth?

The market value of your home will be an important consideration in several decisions you might make, including refinancing, borrowing against the home's accumulated equity, putting the home up for sale, estimating homeowner's insurance, estimating annual property taxes, estimating the return from remodeling jobs, estate planning, and so forth. Remember, how much was paid for the home when it was first purchased is irrelevant to its current market value.

Hobby-Related Loss Deductions Are Disallowed, but Don't Give Up Hope

Let's say you have an unincorporated sideline activity that you think of as a business, including an activity involving horses. If you have a net loss (deductible expenses exceed revenue) on that activity and you think you can deduct that loss on your personal federal income tax return, think again!

The Status of Temporary COVID Tax Relief Measures After the New Law

Before President Trump signed the latest economic stimulus law, several temporary COVID-19-related federal tax relief measures were set to expire on December 31, 2020. This article explains the current status of eight important temporary relief measures and whether the Consolidated Appropriations Act (CAA) extended them.

PPP Loan Changes Included in the New Appropriations Act

The CARESAct created the Paycheck Protection Program (PPP) to issue loans to help small businesses that were adversely affected by the COVID-19 pandemic. The original program expired on August 8, 2020. Now it's been retroactively reinstated, liberalized, and expanded by the new Consolidated Appropriations Act. Here are some key details for small business owners, including clarification about the tax treatment of forgiven PPP loans.

IMPORTANT TAX INFORMATION FOR 2020

SELECTED IMPORTANT 2020 TAX ITEMS:

• Casualty Loss: Effective beginning in 2018, this deduction has been eliminated, with the exception of casualty losses suffered in a federal disaster area. A taxpayer who suffers a personal casualty loss from a disaster declared by the President under section 401 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act will still be able to claim a personal casualty loss as an itemized deduction, subject to the $100-per-casualty and 10%-of-Adjusted Gross Income limitations.

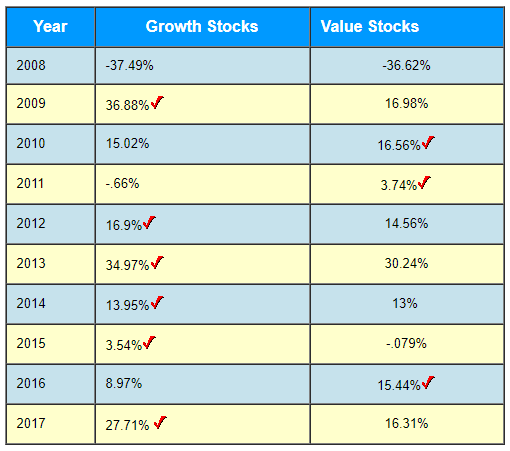

Value Versus Growth Investing

Value investors look for bargains. In other words, they attempt to find stocks that are trading below the value of the companies they represent. In contrast, growth investors are using today's information to identify tomorrow's strongest stocks. Read on to learn more about the strategies that value investors and growth investors use.

Copyright © 2020

Tips to Prevent the Number One Cause of Marital Rift

Tips to Prevent the Number One Cause of Marital Rift

One surveyfound financial matters is "the most common source of discord among American couples." Further, the survey concluded, arguments over money predominantly involve a differing opinion of "needs" versus "wants," unexpected expenses and insufficient savings. Fortunately, couples may be able to head off many of the problems in a marriage that money can cause. Here are ten tips.

Copyright © 2020

FAQs About Tax-Free Disaster Relief Payments During the COVID-19 Crisis

FAQs About Tax-Free Disaster Relief Payments During the COVID-19 Crisis

The COVID-19pandemic has caused many forms of financial distress. If you've been adversely affected by this federally declared disaster, you may be eligible for federal-income-tax-free qualified disaster relief and disaster mitigation payments paid by some employers. Here are some frequently asked questions about these payments, including those made by employers and charities.

Copyright © 2020

Is EEOC Enforcement Reform Coming?

The Equal Opportunity Employment Commission is capping off a busy year of discrimination cases. With the Biden Administration making plans to take the reins in the White House, what can employers expect going forward? This article looks at possibilities and focuses on several enforcement actions that made news in 2020. Read on for more.

Copyright © 2020

Provisions Related to Unemployment Compensation in the Senate-passed CARES Act

Additional Federally Funded Benefits Supplemental Federal Pandemic Unemployment Compensation. Through July 31, 2020, the federal government would provide a temporary Federal Pandemic Unemployment Compensation (FPUC) of $600 a week for any worker eligible for state or federal unemployment compensation (UC) benefits.